Hey, I'm so glad you're here!

YOU WANT TO TRULY LIVE,

AND I WANT TO HELP GUIDE YOU

IN HOW WE CAN ACHIEVE THAT GOAL.

You deserve to work with someone who really understands you. Someone who listens. Someone who truly cares about you and your family. You are not a number.

You want one-stop-shop to save you time, energy and the hassle of telling your story over and over.

You need a Go-To, who knows your story and knows just what to do…

The advice received here, is always Free.

Hey, I'm so glad you're here!

YOU WANT TO TRULY LIVE,

AND I WANT TO HELP GUIDE YOU

IN HOW WE CAN ACHIEVE THAT GOAL.

You deserve to work with someone who really understands you. Someone who listens. Someone who truly cares about you and your family. You are not a number.

You want one-stop-shop to save you time, energy and the hassle of telling your story over and over.

You need a Go-To, who knows your story and knows just what to do…

The advice received here, is always Free.

&

HERE'S HOW WE WORK TOGETHER

TOGETHER, WE CAN OPEN THE DOOR TO YOUR GOALS AND DREAMS.

I CAN HELP YOU LIVE BETTER.

Your journey is just that – it’s your journey.

Which means it will (and should) look unique for you.

The Goal is always:

♥ Help alleviate any financial stresses

♥ Set you up for success

♥ Help you find clarity

♥ Teach you tools so you become a savvy borrower

Have Questions?

Reviews

WHAT PEOPLE ARE SAYING

☆☆☆☆☆

Tori you have been such a pleasure to work with and I feel so lucky we have gotten to build our relationship over the years. You’ve always been one of my biggest supporters in business and in finding my way to purchasing a home. You’ve really gone above and beyond and I feel truly blessed to have you in my life and on this journey. As a first-time homebuyer, you’ve helped make it as stress-free as possible by explaining the processes with me. I thank you from the bottom of my heart!”

Sarah B

Right off the bat, I felt Tori gave me the time and compassion to hear my story. I was embarrassed, nervous and scared of judgement having to explain our current situation and Tori was supportive, non-judgemental and helped us to find the absolute best scenarios to benefit us. She fought for us over and over again until she was satisfied. There are no words for how grateful I am with the entire process. Tori made it so effortless, but even better she became our friend through the process and I think that’s so important when you’re trusting someone with a very large investment!

Sydney M

Button

Home buying is a stressful and intimidating experience, especially as a first time home buyer. Tori is approachable and easy going, which made us comfortable asking all our questions. It was great to be able to send her a text when we were feeling stressed or confused, and she always responded quickly. We felt supported and safe working with Tori, and knew that she always had our best interest in mind. The most value in our experience was that Tori is never further than a call, text or email away. We will definitely be working with Tori again!

Jennifer & Joe L

Button

From the beginning, Tori has treated us like family. She was continuously there for us and helped us through the whole process of buying a home. Even when we had questions and concerns regarding uncertainties, she listened intently, told us her professional opinion, and above all, reminded us that it was our decision and she would be there no matter what we decided. If you have the privilege of meeting Tori and are thinking of working with her, you are in great hands.

Erin M

Button

JOIN MY EMAIL LIST TO RECEIVE TIPS, TOOLS & REAL LIFE INSPO

Thank you for contacting me.

I will get back to you as soon as possible.

Please try again later.

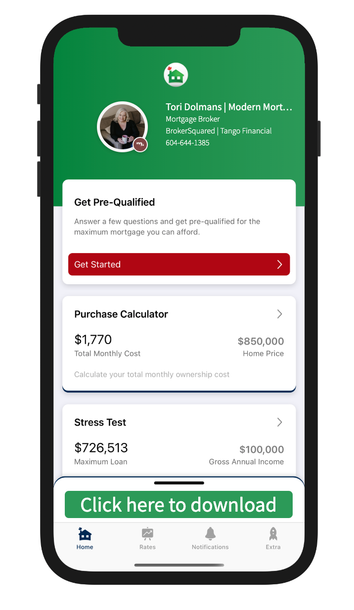

Download My Mortgage Toolbox

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

Articles To Keep You Learning

I can help you arrange mortgage financing for the following services:

Subscribe

Thank you for contacting me.

I will get back to you as soon as possible.

Please try again later.

Follow

@MORTGAGEBYTORI

| Mortgage By Tori | All Rights Reserved | Privacy and Content Notice